Smart Decisions For Voluntary Repossession With No Late Payments

Voluntary repossession with no late payments can be a strategic move for individuals facing financial challenges but wanting to maintain their credit integrity. While the term "repossession" often carries a negative connotation, voluntary repossession can, in some cases, be a proactive approach to managing your financial obligations. When handled correctly, it allows borrowers to relinquish collateral, such as a car or other financed asset, without missing payments or damaging their credit scores further. This approach, however, requires careful planning and a clear understanding of the consequences and benefits involved.

For many, the idea of giving up a vehicle or another financed item may seem daunting, but voluntary repossession can offer a sense of relief if monthly payments have become unmanageable. By choosing this route instead of waiting for a lender to initiate a repossession, borrowers may avoid additional fees, legal complications, and further damage to their credit report. Maintaining a record of no late payments while undergoing voluntary repossession also demonstrates financial responsibility, which could benefit future loan applications.

In this article, we'll explore everything you need to know about voluntary repossession with no late payments. From understanding how the process works to examining its impact on your financial standing, this guide will equip you with the knowledge to make an informed decision. We'll also dive into strategies to minimize the long-term effects on your credit and financial well-being, ensuring you can bounce back stronger from this situation.

Read also:History And Impact Of Rosey Wrestler In The Wrestling World

Table of Contents

- What is Voluntary Repossession?

- How Does Voluntary Repossession Work?

- Why Choose Voluntary Repossession?

- Can Voluntary Repossession Be Done with No Late Payments?

- Step-by-Step Guide to Voluntary Repossession

- What Are the Implications on Your Credit Score?

- Benefits of Voluntary Repossession

- Drawbacks of Voluntary Repossession

- How to Minimize Financial Impact?

- Alternatives to Voluntary Repossession

- Real-Life Examples and Success Stories

- Common Misconceptions About Voluntary Repossession

- Frequently Asked Questions

- Conclusion and Final Thoughts

What is Voluntary Repossession?

Voluntary repossession is the process in which a borrower willingly returns a financed asset, such as a vehicle, to the lender when they are unable to continue making payments. Unlike involuntary repossession, where the lender forcibly takes back the asset, voluntary repossession allows the borrower to initiate the return on their own terms. This decision is often made to avoid further financial strain or legal complications.

Voluntary repossession can be a viable option for individuals who recognize that they can no longer afford to keep up with the payments on a financed asset. By taking the proactive step to return the item, borrowers may save on additional fees and demonstrate a level of responsibility that could mitigate the impact on their credit report.

How does it differ from involuntary repossession?

The primary difference between voluntary and involuntary repossession lies in who initiates the process. Involuntary repossession occurs when the lender takes action to reclaim the asset due to missed payments or a breach of contract. This often involves additional costs, such as towing and storage fees, which are passed on to the borrower. Voluntary repossession, on the other hand, gives the borrower more control over the process and may help reduce these extra expenses.

Key characteristics of voluntary repossession

- The borrower initiates the asset return.

- It may involve fewer penalties and fees compared to involuntary repossession.

- The borrower may have an opportunity to negotiate terms with the lender.

- It still impacts the borrower's credit report but may be less damaging than involuntary repossession.

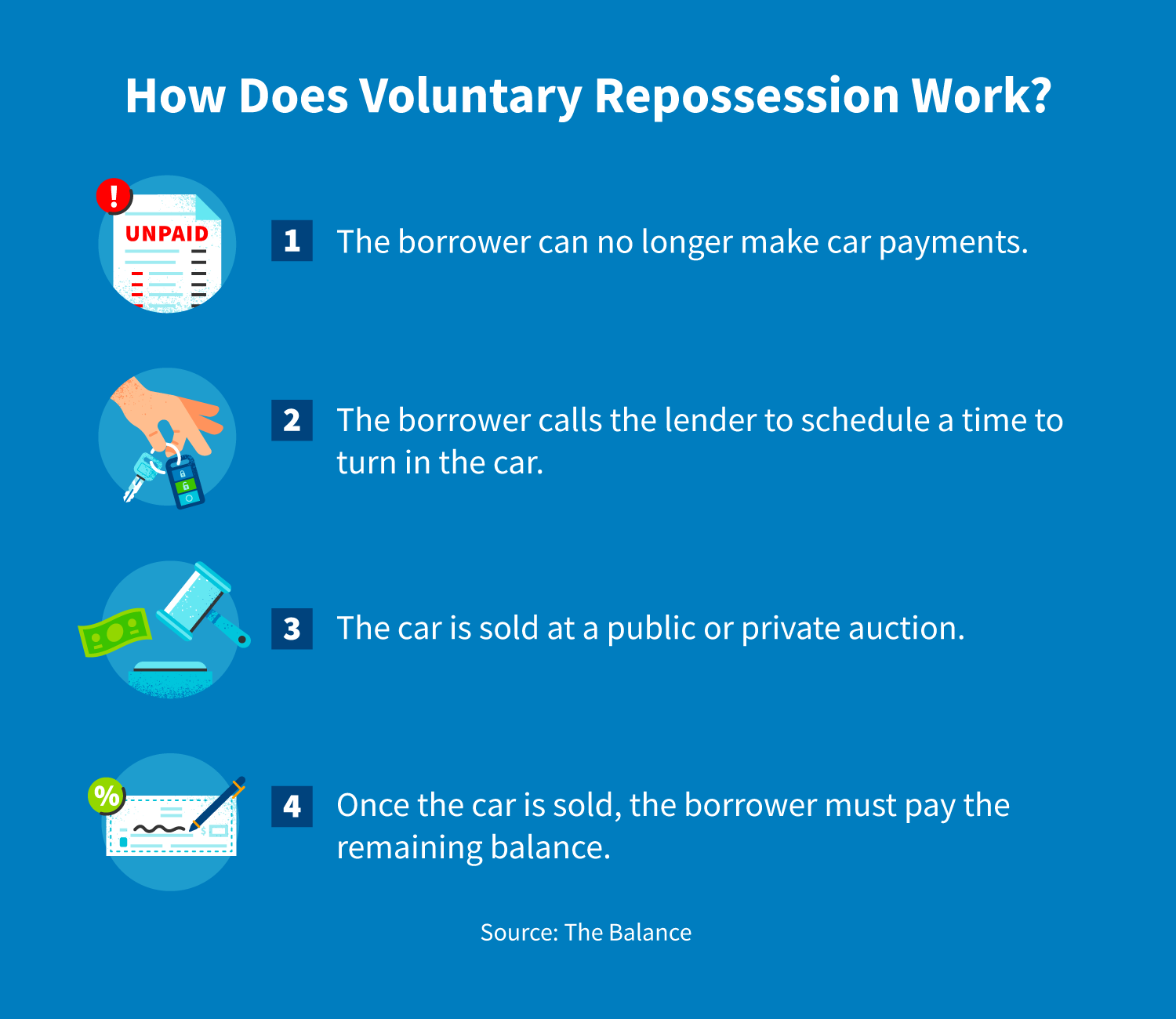

How Does Voluntary Repossession Work?

Understanding the mechanics of voluntary repossession is essential to navigate this process effectively. Here's how it typically works:

1. Assessing your financial situation

The first step in voluntary repossession is to take a close look at your financial health. Determine whether continuing to pay for the financed asset is feasible or if it would be more prudent to return it to the lender. Consider factors such as your income, expenses, and other financial obligations before making a decision.

2. Contacting your lender

Once you've decided to proceed with voluntary repossession, the next step is to reach out to your lender. Inform them of your intention to surrender the asset and discuss the process for doing so. Many lenders are willing to work with borrowers in this situation to minimize complications and costs.

Read also:Comprehensive Insight Into Iowa State Mens Basketball A Complete Guide

3. Preparing the asset for return

Before returning the asset, ensure that it is in good condition and that all personal belongings have been removed. This step demonstrates responsibility and may help improve your rapport with the lender.

4. Formalizing the agreement

Work with your lender to finalize the terms of the voluntary repossession. This may include signing documents that detail the surrender process, any remaining financial obligations, and how the asset will be sold or disposed of.

5. Returning the asset

Finally, deliver the asset to the agreed-upon location, such as the lender's office or a designated drop-off site. Be sure to obtain a receipt or other documentation confirming that the asset has been surrendered.

Why Choose Voluntary Repossession?

Voluntary repossession is not a decision to be taken lightly, but it can be the right choice in certain situations. Here are some reasons why borrowers may opt for this approach:

- To avoid additional fees: Voluntary repossession can help borrowers avoid the towing, storage, and legal fees associated with involuntary repossession.

- To maintain some control: By initiating the process, borrowers can have more say in how the asset is returned and the terms of the repossession.

- To demonstrate responsibility: Choosing voluntary repossession over defaulting on payments shows lenders that the borrower is taking proactive steps to address their financial challenges.

Ultimately, the decision to pursue voluntary repossession should be based on a thorough assessment of your financial situation and a clear understanding of the potential consequences.

Can Voluntary Repossession Be Done with No Late Payments?

One common question borrowers have is whether it's possible to undergo voluntary repossession without having missed any payments. The answer is yes, though it requires careful planning and communication with your lender.

Why is this important?

Maintaining a record of no late payments during voluntary repossession can help mitigate the impact on your credit score. It also demonstrates financial responsibility, which may improve your chances of securing loans in the future.

How to achieve this?

- Communicate with your lender as soon as you realize you may be unable to continue making payments.

- Make any outstanding payments before initiating the repossession process.

- Negotiate terms with your lender to ensure that your payment record remains intact.

By following these steps, you can navigate the voluntary repossession process while minimizing the impact on your financial standing.

Step-by-Step Guide to Voluntary Repossession

...

Frequently Asked Questions

...

Conclusion and Final Thoughts

Voluntary repossession with no late payments is a strategic option for borrowers facing financial hardship. By taking proactive steps, maintaining open communication with lenders, and understanding the implications, you can navigate this process with minimal impact on your financial future. While it comes with challenges, voluntary repossession can also provide a path toward financial stability and peace of mind.

Article Recommendations