Comprehensive Guide To Perland Title And Escrow Services: Ensuring Secure Property Transactions

In the complex world of real estate transactions, perland title and escrow services play a critical role in ensuring that all parties involved are protected and the deal is closed smoothly. These services are crucial in providing security and peace of mind to both buyers and sellers by managing the legal and financial aspects of property transactions. Understanding the intricacies of these services can help you navigate the real estate market with confidence.

Perland title and escrow services are essential for anyone involved in buying or selling property. They ensure that the property title is clear and free of any liens or encumbrances, and that the funds are securely held until all conditions of the sale are met. This dual function is vital in maintaining the integrity of the transaction process and avoiding potential legal disputes. Engaging a reliable title and escrow service can significantly reduce the risks associated with property transactions.

For those entering the real estate market, having a thorough understanding of perland title and escrow services is indispensable. These services safeguard the interests of all parties by guaranteeing the legitimacy of the property’s title and ensuring the secure handling of funds. By delving into the specifics of how these services operate, you can make informed decisions and achieve successful outcomes in your real estate endeavors.

Read also:Benefits And Usage Guide For Vitamin C Serum Your Skins Best Friend

Table of Contents

- What Are Title and Escrow Services?

- Why Are Title and Escrow Important in Real Estate?

- How Do Title Services Work?

- Understanding Escrow Services

- Role of Perland Title and Escrow Services

- Steps Involved in Title and Escrow Process

- Common Challenges and Solutions in Title and Escrow

- Choosing a Reliable Title and Escrow Service

- Costs Associated with Title and Escrow Services

- Impact of Title and Escrow on Buyers and Sellers

- How to Prepare for the Title and Escrow Process?

- Frequently Asked Questions

- Conclusion

What Are Title and Escrow Services?

Title and escrow services are fundamental components of real estate transactions. Title services involve a thorough examination of property records to ensure that the title is clear of any legal issues, such as liens or claims. This process confirms that the seller has the right to transfer ownership to the buyer.

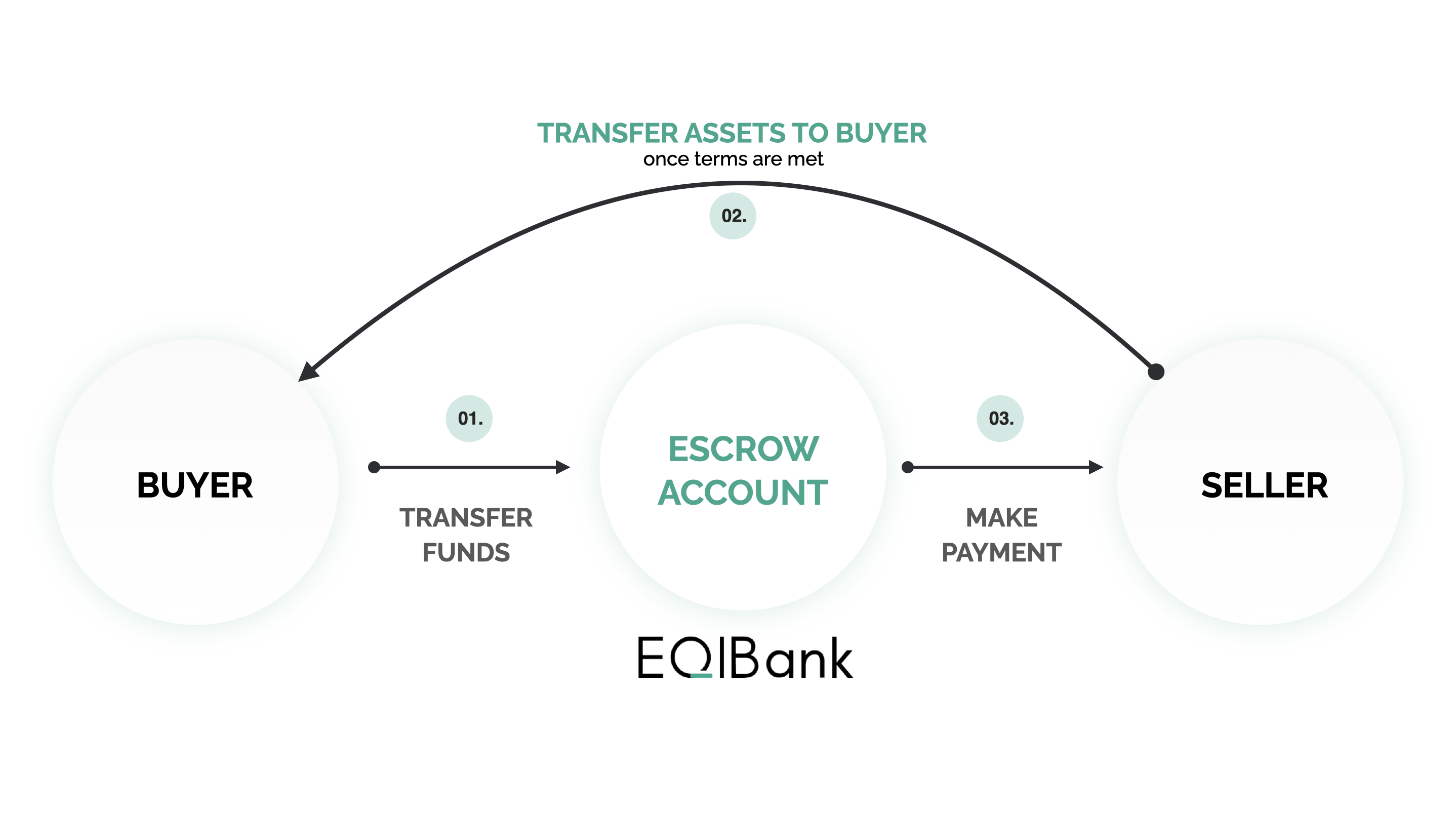

On the other hand, escrow services act as a neutral third party that holds funds and relevant documents until all conditions of the sale are satisfied. The escrow agent manages the transaction details and disburses funds only when both parties have met their contractual obligations. Together, title and escrow services provide a framework for secure and efficient property transfers.

Why Are Title and Escrow Important in Real Estate?

Title and escrow services are crucial in real estate because they provide a safety net for both buyers and sellers. They ensure that the transaction is conducted according to the agreed terms and that all legal requirements are met. Without these services, parties involved in a property transaction could face significant risks, including financial loss or legal disputes.

By verifying the legitimacy of the property's title and managing the financial aspects securely, title and escrow services protect the interests of all parties involved. This not only facilitates a smooth transaction but also helps maintain trust and integrity in the real estate market.

How Do Title Services Work?

Title services begin with a title search, where professionals examine public records to identify any existing claims or issues with the property. This search is crucial to ensure that the property can be legally transferred without future complications.

Once the title is deemed clear, a title insurance policy is issued. This policy protects the buyer and lender from any future claims or losses due to issues that were not identified during the title search. Title services play a pivotal role in confirming property ownership and safeguarding against unforeseen legal challenges.

Read also:Sw Airlines Navigating The Skies With Excellence And Innovation

Understanding Escrow Services

Escrow services provide an added layer of security in real estate transactions by acting as an impartial intermediary. The escrow agent holds the buyer's funds and any necessary documents, releasing them only when all conditions of the sale are met. This ensures that both parties fulfill their contractual obligations before the transaction is finalized.

Escrow services are particularly beneficial in complex transactions, as they help manage contingencies and mitigate risks. By holding funds and documents securely, escrow agents facilitate a smooth and transparent transaction process.

Role of Perland Title and Escrow Services

Perland title and escrow services provide expert support throughout the entire real estate transaction process. They offer comprehensive title searches, issue title insurance policies, and manage escrow accounts with precision and integrity.

With a focus on customer satisfaction and legal compliance, perland title and escrow services ensure that transactions are executed smoothly and securely. Their expertise in navigating complex legal and financial landscapes makes them invaluable partners in real estate deals.

Steps Involved in Title and Escrow Process

The title and escrow process involves several key steps:

- Title Search: A thorough examination of public records to identify any title issues.

- Title Insurance: Issuance of insurance policy to protect against future claims.

- Escrow Account Setup: Establishment of an account to hold funds and documents securely.

- Document Review: Verification of all transaction-related documents for accuracy and completeness.

- Closing: Finalization of the transaction with the transfer of ownership and disbursement of funds.

Each step is crucial to ensure a seamless and legally compliant property transfer.

Common Challenges and Solutions in Title and Escrow

Despite their importance, title and escrow services can present challenges, such as delays due to title defects or discrepancies in documentation. These issues can be mitigated by working with experienced professionals who can identify and resolve problems promptly.

Clear communication and thorough documentation are essential in overcoming challenges in title and escrow services. By proactively addressing potential issues, parties can ensure a smooth and successful transaction.

Choosing a Reliable Title and Escrow Service

Selecting the right title and escrow service is critical for a successful real estate transaction. Considerations should include the company's reputation, experience, and customer reviews. It's important to choose a service provider that is knowledgeable, trustworthy, and committed to protecting your interests.

Interviewing multiple service providers and asking for recommendations can help you find a reliable partner for your real estate needs.

Costs Associated with Title and Escrow Services

Understanding the costs involved in title and escrow services is crucial for budgeting in a real estate transaction. These costs typically include title search fees, insurance premiums, and escrow fees. While these expenses can vary based on location and property value, they are essential for ensuring a secure and legally compliant transaction.

To avoid surprises, it's advisable to request a detailed fee breakdown from your service provider upfront.

Impact of Title and Escrow on Buyers and Sellers

Title and escrow services significantly impact both buyers and sellers by ensuring that the transaction is conducted fairly and legally. For buyers, these services provide assurance of clear ownership and protection against future claims. For sellers, they facilitate the secure transfer of property and receipt of funds.

By understanding the role and benefits of title and escrow services, both parties can approach the transaction with confidence and peace of mind.

How to Prepare for the Title and Escrow Process?

Preparation is key to a successful title and escrow process. Both buyers and sellers should gather all necessary documents, such as identification, property deeds, and financial records. It's also important to communicate openly with your real estate agent and title or escrow officer to ensure that all requirements are met.

By being proactive and organized, you can help facilitate a smooth and efficient transaction.

Frequently Asked Questions

1. What happens if there is a problem with the title?

If a problem is discovered during the title search, the issue must be resolved before the transaction can proceed. This may involve clearing liens or resolving ownership disputes.

2. Can the buyer choose the escrow service?

In many cases, the buyer has the right to select the escrow service provider. However, this can vary based on local practices and agreements between the parties.

3. How long does the escrow process typically take?

The escrow process can vary in length, usually taking between 30 to 60 days, depending on the complexity of the transaction and any contingencies involved.

4. Are title and escrow fees negotiable?

Some fees associated with title and escrow services may be negotiable. It's wise to discuss this with your service provider to understand your options.

5. What documents are needed for the escrow process?

Documents typically required for escrow include the purchase agreement, property deeds, identification, and loan documents, among others.

6. Can escrow be canceled?

Yes, escrow can be canceled if both parties agree to terminate the transaction, or if one party fails to meet the contractual conditions.

Conclusion

Perland title and escrow services play a vital role in the real estate market, ensuring secure and legally compliant transactions. By understanding their functions and benefits, buyers and sellers can navigate the complexities of property transactions with confidence. Whether you are buying or selling, engaging reliable title and escrow services is essential to protecting your interests and facilitating a successful deal.

For more detailed information and guidance, consider visiting Consumer Financial Protection Bureau, a valuable resource for understanding real estate transactions.

Article Recommendations