Mastering The Art Of Writing A Cheque At TD Bank: A Step-by-Step Guide

When it comes to writing a cheque, it's crucial to get every step right. From filling in the date to signing your name, each part of the cheque plays an important role in ensuring your transaction is completed successfully. With the right knowledge, you can avoid the common pitfalls that others face. This guide will not only instruct you on the technical aspects but also provide insights into why each part is necessary for a secure transaction. By the end of this article, you'll have a solid understanding of how to write a cheque at TD Bank, and you'll feel confident whether you're making a payment or receiving one. We'll explore each element of the cheque, offer tips for avoiding mistakes, and even delve into TD Bank's specific requirements and security features. So, let's get started on this essential financial skill!

| Topic | Details |

|---|---|

| Bank Name | TD Bank |

| Cheque Writing Process | Step-by-step guidance |

| Security Features | Specific to TD Bank |

| Common Mistakes | How to avoid them |

Table of Contents

- Why Write a Cheque?

- Essential Elements of a Cheque

- How to Write a Cheque at TD Bank

- Common Mistakes to Avoid When Writing a Cheque

- How Do I Ensure the Cheque Is Secure?

- What Happens When a Cheque Bounces?

- The Importance of Keeping Track of Cheques

- Are There Alternatives to Using Cheques?

- How to Cancel a Cheque?

- FAQs

- Conclusion

Why Write a Cheque?

Even in today's digital age, cheques hold significant value. They are a secure method for making payments, especially for transactions involving large amounts or when electronic transfers are not suitable. Cheques also provide a paper trail, which can be essential for record-keeping and tracking expenses. Moreover, they are accepted universally, making them a preferred choice for many, including businesses and individuals who prefer traditional banking methods.

Writing a cheque allows you to control exactly when the funds are withdrawn from your account, offering more flexibility than electronic payments. This could be particularly useful for budgeting purposes or when managing multiple accounts. Cheques are also a tangible form of payment, which can be reassuring for some people who prefer a physical confirmation of their transaction.

Read also:Meet The Cast Boy Swallows Universe Stars Shine Bright

Moreover, cheques can be personalized. Businesses often customize cheques with their logos and branding, providing a professional touch to their transactions. This personalization can help reinforce brand identity and ensure all payments are associated with the correct business entity.

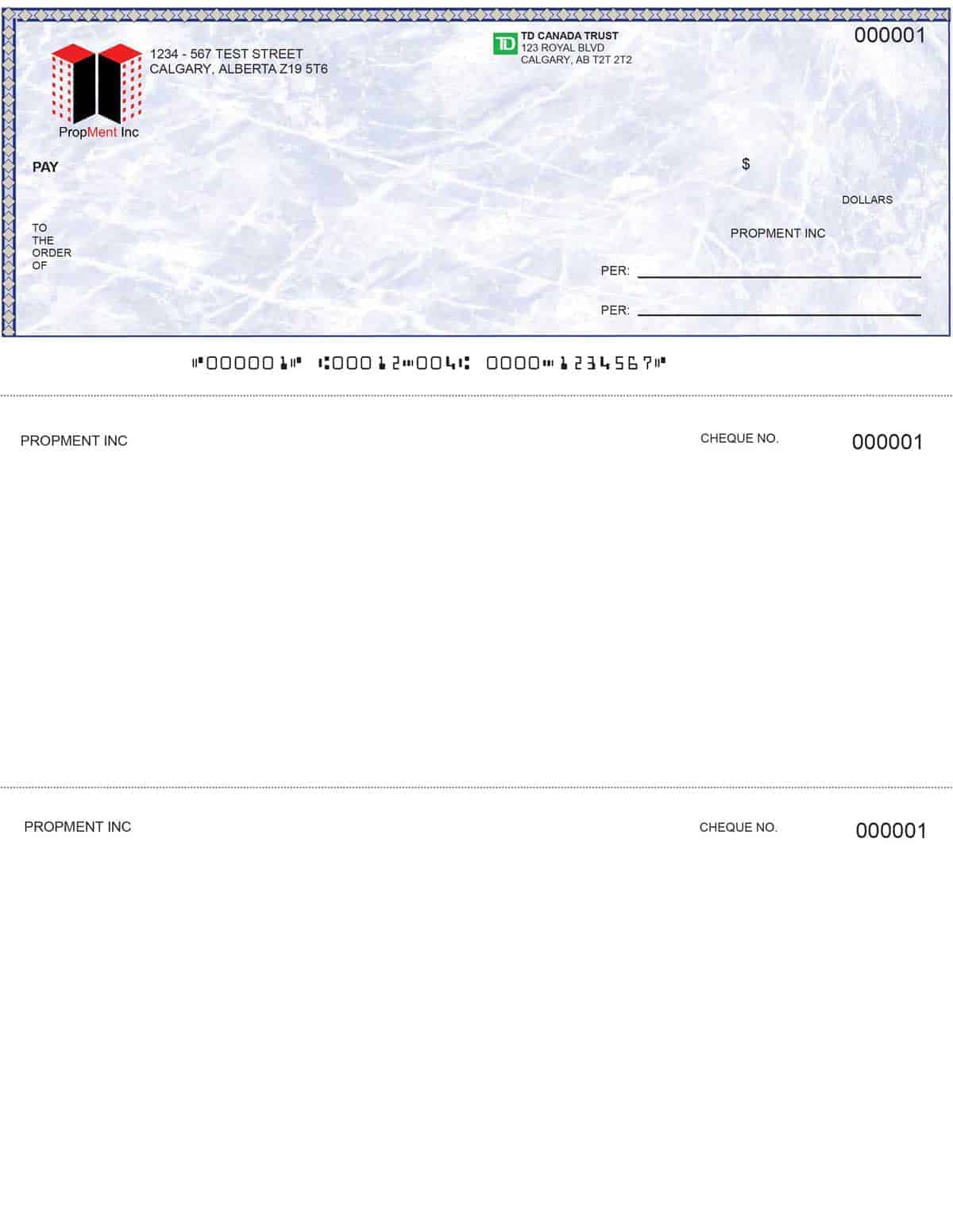

Essential Elements of a Cheque

Understanding the fundamental parts of a cheque is the first step in mastering how to write a cheque at TD Bank. Each cheque comprises several key elements:

- Date Line: This is where you write the date the cheque is issued.

- Payee Line: The name of the individual or entity to whom the cheque is being paid.

- Amount in Numbers: The exact amount of money being transferred, written in numerical form.

- Amount in Words: This is the written form of the amount, confirming the numerical value.

- Signature Line: Your signature, authorizing the withdrawal of the specified amount from your account.

- Memo Line: An optional section where you can note the purpose of the cheque.

- Cheque Number: A unique identifier for the cheque, helping with tracking and record-keeping.

Each of these components plays a crucial role in ensuring the cheque is processed correctly. Missing or incorrect information can result in delays or the cheque being rejected. Therefore, it's essential to fill out each part meticulously and double-check for accuracy.

How to Write a Cheque at TD Bank

Writing a cheque at TD Bank involves a simple process, but it requires attention to detail to ensure accuracy. Here’s a step-by-step guide on how to write a cheque at TD Bank:

- Start with the Date: In the top right corner, write the current date. This can be written in various formats, such as "MM/DD/YYYY" or "Month Day, Year", but ensure it is clear and legible.

- Fill in the Payee: On the "Pay to the Order of" line, write the name of the person or business you are paying. Make sure the name is spelled correctly to avoid any issues with the cheque being cashed or deposited.

- Write the Amount in Numbers: In the box next to the payee line, indicate the amount of the cheque in numerical form. Start at the far left of the box to prevent alterations.

- Write the Amount in Words: Below the payee line, write out the amount in words. This helps verify the numerical amount. For example, $50.25 would be written as "Fifty dollars and 25/100".

- Include a Memo: The memo line is optional, but it can be helpful for personal record-keeping. You might write "Rent for May" or "Invoice #12345".

- Sign the Cheque: The signature line is located at the bottom right of the cheque. Your signature authorizes the bank to process the cheque and release funds.

After you have completed these steps, review the cheque for any errors or omissions. A small mistake can lead to delays or the cheque being returned. If you need to make corrections, it's often easier to void the cheque and start anew rather than make alterations on it.

Common Mistakes to Avoid When Writing a Cheque

While writing a cheque might seem straightforward, there are common mistakes that can cause issues. Here's what to watch out for:

Read also:Illuminating The Life And Career Of Masi Oka A Dynamic Force In Entertainment

- Incorrect Date: Post-dating a cheque or using the wrong date format can lead to confusion or rejection.

- Improper Payee Name: Misspelling or using incorrect names can prevent the cheque from being deposited.

- Mismatched Amount: Ensure the numerical and written amounts match. Discrepancies can cause the cheque to be invalid.

- Missing Signature: A cheque without your signature is not valid and will be returned.

- Alterations: Avoid making changes to the cheque once it’s written. If necessary, void the cheque and write a new one.

Avoiding these mistakes will ensure your cheque is processed smoothly and quickly. Taking a few extra moments to double-check your work can save you from unnecessary headaches.

How Do I Ensure the Cheque Is Secure?

Security is paramount when dealing with cheques. Here are some steps to enhance the security of your cheques:

- Use Permanent Ink: Always use a pen with permanent ink to fill out your cheque. This prevents alterations.

- Keep Cheques in a Safe Place: Store your cheques in a secure location to prevent unauthorized access.

- Monitor Your Bank Account: Regularly check your bank statements to ensure all transactions are accurate and authorized.

- Shred Old Cheques: Dispose of old or voided cheques by shredding them to prevent identity theft.

By following these security measures, you can protect your finances and ensure that your cheques are used as intended.

What Happens When a Cheque Bounces?

A bounced cheque occurs when there are insufficient funds in the account to cover the payment. This can result in fees from both your bank and the payee's bank, and it can damage your credit score. Here's what you can do if your cheque bounces:

- Contact the Payee: As soon as you become aware of the issue, reach out to the payee to explain the situation and arrange for repayment.

- Check Your Account: Ensure there are enough funds in your account to cover the cheque, and consider transferring funds if needed.

- Cover Fees: Be prepared to pay any associated fees from your bank.

It's crucial to address a bounced cheque promptly to maintain good financial standing and avoid further complications.

The Importance of Keeping Track of Cheques

Despite the convenience of digital banking, keeping a physical record of your cheque transactions is vital. It helps in reconciling your bank statements and identifying any discrepancies. Follow these tips to keep track of your cheques:

- Use a Cheque Register: Record each cheque you write in a cheque register, noting the date, payee, and amount.

- Reconcile Regularly: Compare your cheque register with your bank statement regularly to ensure accuracy.

- Save Copies: Keep copies of important cheques for your records, especially if they're related to taxes or legal matters.

By maintaining detailed records, you'll have a clear picture of your financial transactions and can quickly address any issues that arise.

Are There Alternatives to Using Cheques?

While cheques are a reliable payment method, there are alternatives that offer convenience and speed. Consider these options:

- Electronic Transfers: Services like Interac e-Transfer allow for quick and secure money transfers between accounts.

- Online Bill Payments: Most banks offer online platforms for paying bills directly from your account.

- Debit and Credit Cards: Cards provide a convenient way to make purchases and payments without the need for cash or cheques.

These alternatives can be particularly useful for recurring payments or when you need to transfer money quickly.

How to Cancel a Cheque?

Canceling a cheque, also known as a "stop payment," is necessary if you've lost a cheque or suspect fraudulent activity. Here’s how you can do it at TD Bank:

- Contact TD Bank: Call or visit your local branch to initiate the stop payment process.

- Provide Details: You’ll need to provide the cheque number, amount, and payee's name to stop the payment.

- Pay Fees: Be prepared to pay a fee for the stop payment service.

Acting quickly can prevent unauthorized use of your cheque and protect your funds.

FAQs

What should I do if I make a mistake on a cheque?

If you make a mistake, it's best to void the cheque and write a new one. Simply write "VOID" across the cheque and keep it for your records.

Can I write a post-dated cheque?

Yes, you can write a post-dated cheque, but the bank may process it as soon as it is deposited. Ensure you have sufficient funds by the date written on the cheque.

How long does it take for a cheque to clear?

Cheque processing times can vary, but it generally takes 2-5 business days for a cheque to clear. Factors like the bank's policies and the payee's account details can affect this timeline.

What if my cheque gets lost in the mail?

If a cheque is lost, contact your bank immediately to issue a stop payment and write a new cheque if necessary.

Can I deposit a cheque using my phone?

Yes, TD Bank offers mobile deposit services through their app, allowing you to deposit cheques using your smartphone.

Are there fees associated with writing cheques?

While writing cheques is typically free, you may incur fees for special services like ordering cheque books or stopping payments.

Conclusion

Writing a cheque at TD Bank is a straightforward process once you understand the essential components and common pitfalls. By following the step-by-step guide outlined in this article, you can ensure your cheques are completed accurately and securely. Whether you're using cheques for personal or business transactions, mastering this skill will serve you well in managing your finances. Remember, keeping track of your cheques and maintaining security are crucial aspects of effective cheque management. With this knowledge, you’re well-equipped to handle any cheque-writing needs that come your way.

For more information on financial management and banking services, consider visiting Investopedia, a reliable source for financial education and tips.

Article Recommendations