CPA Score Release 10/31: What You Need To Know

Each year, the CPA score release dates are set by the American Institute of Certified Public Accountants (AICPA), and the October 31st release is one of the final opportunities for candidates to receive their scores for the year. The process of waiting for these results can be nerve-wracking, as the outcome will impact candidates' plans for their professional development. Understanding the scoring process and what to expect on the release date can help candidates manage their expectations and plan their next steps accordingly. In this article, we will delve into the details of the CPA score release on October 31st. We will cover a comprehensive range of topics, including the scoring process, the significance of the results, preparation tips, and the implications of the scores. Additionally, we will answer frequently asked questions to provide a thorough understanding of what candidates can expect. Our aim is to offer valuable insights and guidance for those eagerly awaiting their CPA exam results. Table of Contents: 1. Understanding the CPA Exam and Its Importance 2. What Is the CPA Score Release 10/31? 3. How Are CPA Exam Scores Calculated? 4. Why Is the October 31st Release Significant? 5. Preparing for the CPA Score Release 6. What to Expect on the CPA Score Release Date? 7. How to Access Your CPA Exam Scores 8. Interpreting Your CPA Exam Results 9. What to Do If You Don't Pass the CPA Exam? 10. Tips for Improving Your CPA Exam Scores 11. The Role of CPA Scores in Career Progression 12. How Does the CPA Score Release Affect Job Opportunities? 13. Common Concerns About CPA Score Release 14. Frequently Asked Questions (FAQs) 15. Conclusion: Moving Forward After the CPA Score Release

Understanding the CPA Exam and Its Importance

The Certified Public Accountant (CPA) exam is a pivotal assessment designed to evaluate the competency and proficiency of individuals aspiring to become certified accountants. Administered by the American Institute of Certified Public Accountants (AICPA), the CPA exam is a comprehensive test that covers various domains such as auditing, taxation, financial accounting, and business concepts.

The significance of the CPA exam extends beyond mere certification; it serves as a benchmark for quality and credibility in the accounting profession. Passing the CPA exam demonstrates a candidate's mastery of essential accounting principles and practices, which is crucial for professional growth and career advancement. As such, the CPA exam is often regarded as a critical milestone for individuals seeking to establish themselves in the accounting and finance sectors.

Read also:Ultimate Guide To Scalp Psoriasis Causes Symptoms And Treatments

Moreover, obtaining a CPA designation opens up a plethora of opportunities in diverse fields, including public accounting, corporate finance, government, and academia. Employers highly value CPA-certified professionals due to their demonstrated expertise, ethical standards, and commitment to continuous learning. Therefore, acing the CPA exam is not only a testament to one's capabilities but also a gateway to a rewarding and fulfilling career.

What Is the CPA Score Release 10/31?

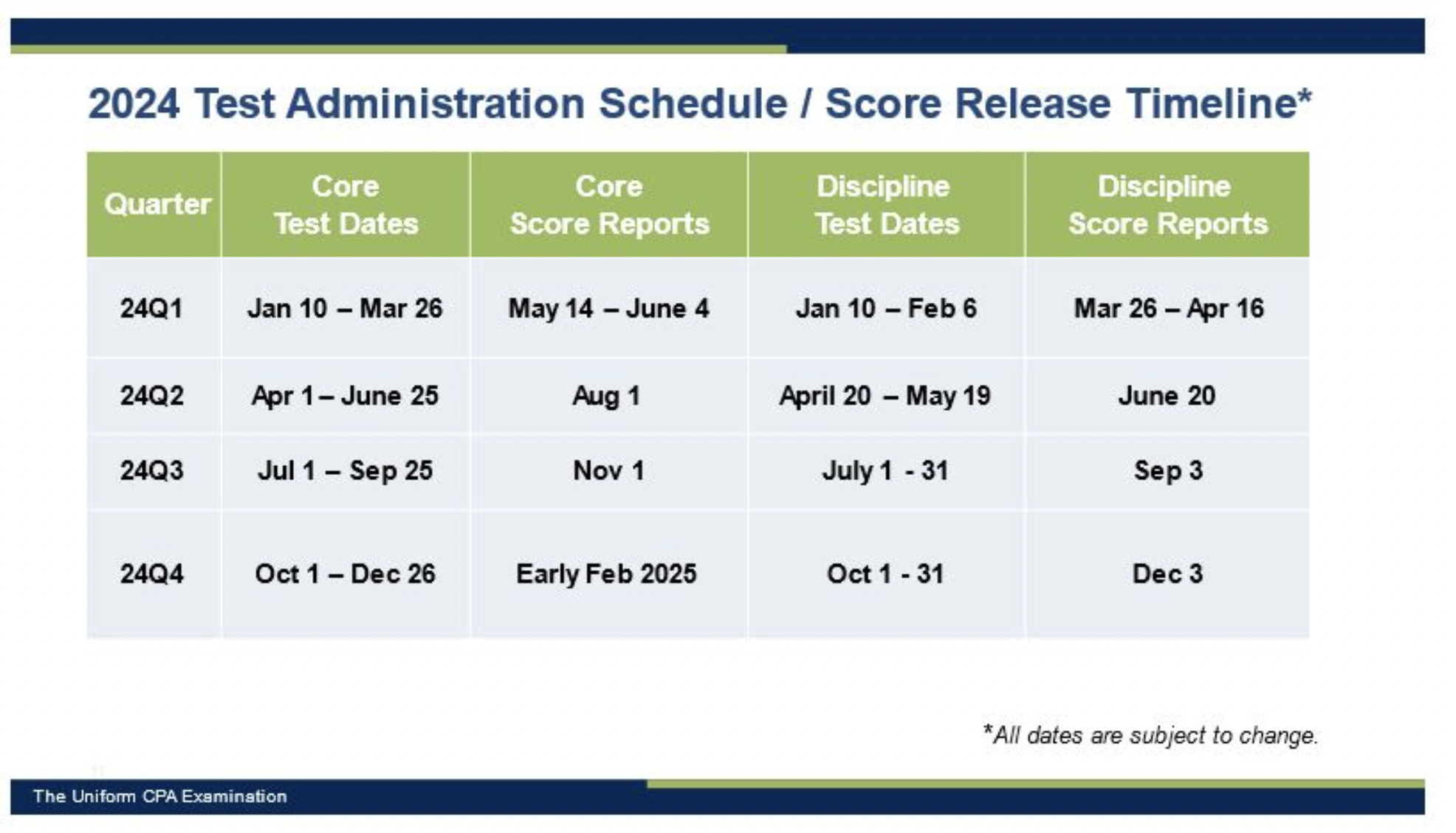

The CPA score release on October 31st is one of the designated dates when the American Institute of Certified Public Accountants (AICPA) officially releases the scores for the CPA exam. These release dates are strategically scheduled throughout the year to provide candidates with timely feedback on their performance. The October 31st release is particularly notable as it typically represents one of the last opportunities for candidates to receive their results within a given year.

During each testing window, candidates sit for various sections of the CPA exam, which includes Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). After completing these sections, candidates eagerly await their scores to determine whether they have met the passing criteria. The CPA score release on October 31st is, therefore, a significant event for many candidates who have dedicated substantial time and effort to their exam preparation.

Understanding the timing and process of the CPA score release is crucial for candidates as it helps them plan their next steps effectively. Whether they pass or need to retake certain sections, candidates can use the feedback from their scores to make informed decisions about their professional development and career trajectory.

How Are CPA Exam Scores Calculated?

The calculation of CPA exam scores is a meticulous process that involves a combination of scaled scoring and equating methodologies. Each section of the CPA exam is scored on a scale that ranges from 0 to 99, with a passing score set at 75. This scoring system is designed to ensure consistency and fairness in evaluating candidates' performance across different exam administrations.

The CPA exam employs a combination of multiple-choice questions (MCQs), task-based simulations (TBS), and written communication tasks, depending on the section being tested. The scores for these components are weighted differently, with MCQs generally contributing a significant portion of the overall score. The exact weighting varies by exam section, reflecting the distinct focus and objectives of each component.

Read also:Ava Daniels An Illuminating Profile And Unseen Dimensions

To ensure equitable scoring, the AICPA utilizes a process called 'equating,' which adjusts scores to account for variations in exam difficulty across different testing windows. This means that even if one version of the exam is slightly more challenging than another, the scoring process ensures that candidates are assessed fairly and consistently.

The final score is a reflection of a candidate's overall performance across all components of a section, and only those who achieve a score of 75 or higher are considered to have passed that section. Understanding the scoring methodology is essential for candidates as it provides insight into how their performance is measured and evaluated.

Why Is the October 31st Release Significant?

The CPA score release on October 31st holds particular significance for several reasons. Firstly, it represents one of the last opportunities in the year for candidates to receive their CPA exam results. This timing is crucial for those who aim to complete their certification requirements within the calendar year, as it allows them to plan their next steps accordingly.

Additionally, receiving scores on October 31st provides candidates with a clear understanding of their progress in the certification process. For those who pass all required sections, this milestone marks the culmination of their hard work and dedication, paving the way for them to officially obtain their CPA designation. For others, it may highlight areas where further study and preparation are needed, enabling them to focus their efforts on improving their performance.

The October 31st release also has implications for candidates' career plans. Many firms and organizations have hiring cycles that align with the end of the fiscal year, making it an opportune time for candidates to leverage their CPA designation in job applications and interviews. As such, the timely release of scores can enhance candidates' prospects for securing desirable positions in the accounting and finance sectors.

Preparing for the CPA Score Release

As the CPA score release date approaches, candidates can take several steps to prepare themselves mentally and emotionally for the outcome. While the anticipation of receiving exam results can be nerve-wracking, careful planning and a positive mindset can help candidates manage their expectations and reduce anxiety.

Here are some tips for preparing for the CPA score release:

- Review Your Exam Performance: Reflect on your exam experience and consider any areas where you felt particularly confident or challenged. This self-assessment can provide valuable insights into your strengths and areas for improvement.

- Stay Informed: Keep track of any updates or announcements from the AICPA regarding the score release process. Being informed can help you avoid unnecessary stress and confusion on the release date.

- Plan for Different Outcomes: Consider the possible scenarios based on your exam results and outline a plan for each. Whether you pass or need to retake a section, having a clear plan in place can help you move forward with confidence.

- Seek Support: Reach out to peers, mentors, or professional networks for support and encouragement. Sharing your experiences and concerns with others who have gone through the process can provide reassurance and motivation.

- Practice Self-Care: Prioritize your well-being by engaging in activities that help you relax and recharge. Whether it's exercise, meditation, or spending time with loved ones, taking care of yourself can help you approach the score release with a positive mindset.

What to Expect on the CPA Score Release Date?

On the CPA score release date, candidates can expect to receive their exam scores through the official online portal provided by the National Association of State Boards of Accountancy (NASBA). The process of accessing scores is straightforward, but candidates should be prepared for potential delays due to high traffic on the website.

Here are some key points to keep in mind for the CPA score release date:

- Timing: Scores are typically released in the early hours of the morning, but the exact timing may vary. Candidates are advised to check the official NASBA website for updates on the release schedule.

- Accessing Scores: Candidates will need to log in to their NASBA accounts using their credentials to view their scores. It is important to ensure that login information is up to date and accessible ahead of time.

- Score Reports: The score report will provide detailed information about the candidate's performance in each exam section, including scaled scores and performance feedback. Reviewing this information can help candidates understand their strengths and areas for improvement.

- Technical Issues: Due to the high volume of candidates accessing the portal simultaneously, there may be temporary technical issues or delays. Candidates should remain patient and try accessing their scores at different times if they encounter difficulties.

- Emotional Preparedness: Regardless of the outcome, candidates should approach the score release with a balanced perspective. Celebrating successes and acknowledging the need for further effort are both important aspects of the journey towards CPA certification.

How to Access Your CPA Exam Scores

Accessing CPA exam scores is a straightforward process that involves logging into the National Association of State Boards of Accountancy (NASBA) online portal. Candidates who have registered for the CPA exam will have an account on the NASBA website, which serves as the primary platform for accessing their exam results.

To access your CPA exam scores, follow these steps:

- Visit the NASBA website: Navigate to the official NASBA website and locate the login section for candidates.

- Enter your credentials: Input your username and password to access your account. Ensure that your login information is accurate and up to date.

- Navigate to the score release section: Once logged in, find the section dedicated to score releases, where you will be able to view your exam results.

- View your score report: Your score report will display your performance in each exam section, including your scaled score and any additional feedback provided by the AICPA.

- Download or print your results: For your records, consider downloading or printing a copy of your score report. This can be useful for future reference or for sharing with potential employers.

It's important to note that score release dates may vary slightly based on individual circumstances, such as the jurisdiction in which you took the exam. Therefore, candidates should stay informed about any specific instructions or guidelines provided by their state board of accountancy.

Interpreting Your CPA Exam Results

Interpreting CPA exam results is a crucial step in understanding your performance and planning your next steps towards certification. The score report provides detailed information about your performance in each section of the exam, which can serve as a valuable tool for self-assessment and improvement.

Here are some key components of the CPA exam score report and how to interpret them:

- Scaled Scores: Each section of the CPA exam is scored on a scale from 0 to 99, with a passing score set at 75. A score of 75 or higher indicates that you have met the passing criteria for that section.

- Performance Feedback: The score report may include performance feedback that highlights your strengths and weaknesses in specific content areas. This feedback can help you identify areas where additional study or practice may be needed.

- Comparison to Passing Candidates: Some score reports may provide comparative data that shows how your performance aligns with that of passing candidates. This information can offer insights into areas where you may need to focus your efforts.

- Section-Specific Insights: Each section of the CPA exam tests different competencies and knowledge areas. Reviewing your performance in each section can help you understand which areas you have mastered and which require further attention.

- Plan for Improvement: Based on your score report, develop a study plan that targets areas of weakness and reinforces areas of strength. This strategic approach can enhance your chances of success in future exam attempts.

Interpreting your CPA exam results with an objective and analytical mindset is essential for making informed decisions about your certification journey. Whether you pass or need to retake sections, understanding your performance is the first step towards achieving your CPA goals.

What to Do If You Don't Pass the CPA Exam?

If you don't pass the CPA exam, it's important to approach the situation with a positive and proactive mindset. While the outcome may be disappointing, it also provides an opportunity to learn from the experience and refine your approach for future attempts. Here are some steps to consider if you find yourself in this situation:

1. Reflect on Your Experience: Take some time to reflect on your exam experience and identify any factors that may have contributed to your performance. Consider aspects such as study habits, time management, and familiarity with exam content.

2. Analyze Your Score Report: Carefully review your score report to understand your strengths and areas for improvement. Use the performance feedback provided to guide your study efforts and focus on areas where you need additional practice.

3. Develop a Study Plan: Based on your analysis, create a targeted study plan that addresses your weaknesses and reinforces your strengths. Consider using a variety of study materials and resources to enhance your understanding of the content.

4. Seek Support and Resources: Reach out to peers, mentors, or professional networks for support and advice. Consider enrolling in review courses or utilizing study groups to gain different perspectives and insights.

5. Stay Motivated: Maintaining a positive attitude and staying motivated is crucial for success. Remind yourself of your long-term goals and the value of earning your CPA designation.

6. Plan for Retakes: Determine when you plan to retake the exam and register for the necessary sections. Use the time leading up to the retake to refine your preparation and build your confidence.

Remember that many successful CPAs have faced setbacks along the way, and perseverance is key to achieving your certification goals. By taking a strategic and determined approach, you can overcome challenges and move closer to earning your CPA designation.

Tips for Improving Your CPA Exam Scores

Improving your CPA exam scores requires a combination of effective study strategies, time management, and a positive mindset. Whether you're preparing for your first attempt or aiming to improve your scores, these tips can help enhance your performance:

- 1. Create a Study Schedule: Develop a structured study schedule that allocates dedicated time for each exam section. Consistency and discipline are key to effective preparation.

- 2. Use Diverse Study Materials: Utilize a variety of study resources, including textbooks, online courses, practice exams, and flashcards. Different formats can reinforce your understanding and retention of key concepts.

- 3. Focus on Weak Areas: Identify your areas of weakness and prioritize them in your study plan. Targeted practice and review can help you strengthen your knowledge and skills.

- 4. Practice Time Management: Simulate exam conditions by practicing under timed constraints. This will help you develop effective time management skills and improve your ability to complete the exam within the allotted time.

- 5. Join Study Groups: Collaborate with peers in study groups to share insights, discuss challenging topics, and gain different perspectives. Group study can enhance your understanding and motivation.

- 6. Take Care of Yourself: Prioritize self-care and well-being by getting enough rest, eating healthily, and engaging in activities that reduce stress. A balanced lifestyle can boost your focus and productivity.

By implementing these tips and maintaining a positive attitude, you can improve your CPA exam scores and move closer to achieving your certification goals. Remember that persistence and dedication are essential components of success in the CPA exam journey.

The Role of CPA Scores in Career Progression

CPA scores play a crucial role in career progression for individuals pursuing a career in accounting and finance. Earning a CPA designation demonstrates a candidate's expertise, commitment to ethical standards, and dedication to continuous learning, which are highly valued by employers in the industry.

Here are some ways in which CPA scores impact career progression:

- 1. Credential Recognition: Passing the CPA exam and earning the CPA designation enhances your professional credibility and recognition within the accounting and finance sectors.

- 2. Job Opportunities: CPA-certified professionals have access to a wide range of job opportunities in public accounting, corporate finance, government agencies, and academia. The designation is often a requirement for senior and leadership roles.

- 3. Competitive Advantage: CPA certification provides a competitive advantage in the job market, as employers seek candidates with demonstrated expertise and a commitment to professional excellence.

- 4. Salary Potential: CPA-certified professionals often command higher salaries and benefits compared to their non-certified counterparts. The designation is associated with increased earning potential and career advancement.

- 5. Career Growth: The CPA designation opens up opportunities for career growth and development, including the potential to specialize in niche areas, pursue leadership roles, and engage in continuous professional development.

By achieving high CPA scores and earning the CPA designation, individuals can position themselves for a successful and rewarding career in the accounting and finance industry. The designation serves as a testament to their skills, knowledge, and dedication to the profession.

How Does the CPA Score Release Affect Job Opportunities?

The CPA score release has a direct impact on job opportunities for candidates who are pursuing careers in accounting and finance. The results of the CPA exam can influence candidates' eligibility for certain roles, their competitiveness in the job market, and their potential for career advancement.

Here's how the CPA score release affects job opportunities:

- 1. Certification Requirement: Many employers require candidates to have passed the CPA exam as a prerequisite for certain positions, especially those in public accounting and auditing. The score release confirms candidates' eligibility for these roles.

- 2. Credential Verification: Employers use CPA exam scores to verify candidates' credentials and assess their expertise in accounting principles and practices. High scores can enhance candidates' credibility and appeal to potential employers.

- 3. Competitive Edge: Candidates who have passed the CPA exam are often viewed as more competitive in the job market. The designation demonstrates a commitment to professional excellence and a mastery of key accounting concepts.

- 4. Career Advancement: CPA-certified professionals have access to a wider range of job opportunities and career advancement prospects. The designation is often associated with leadership roles and increased responsibilities.

- 5. Networking Opportunities: Passing the CPA exam opens up networking opportunities with other certified professionals, industry associations, and potential employers. These connections can lead to job opportunities and career growth.

Overall, the CPA score release plays a significant role in shaping candidates' career trajectories and enhancing their prospects for success in the accounting and finance industry. By achieving high scores and earning the CPA designation, candidates can unlock a wealth of opportunities for professional growth and advancement.

Common Concerns About CPA Score Release

The CPA score release can be a source of anxiety and concern for candidates who are eagerly awaiting their exam results. Understanding common concerns and addressing them with accurate information can help alleviate stress and provide clarity about the process.

Here are some common concerns about the CPA score release and how to address them:

- 1. Timing of Score Release: Candidates often worry about when their scores will be released and whether there will be delays. To address this concern, candidates should stay informed about the official score release schedule provided by the AICPA and NASBA.

- 2. Accessing Scores: Some candidates may experience technical difficulties when accessing their scores on the NASBA portal. To mitigate this issue, candidates should ensure their login credentials are accurate and try accessing the portal at different times if they encounter delays.

- 3. Understanding Scores: Candidates may have questions about how their scores are calculated and what they mean. Reviewing the score report and understanding the scoring methodology can provide clarity about performance and areas for improvement.

- 4. Retake Options: Candidates who don't pass may be concerned about the process for retaking the exam. Understanding the retake policies and planning for future attempts can help candidates approach the situation with confidence.

- 5. Impact on Career Plans: Concerns about how exam results will affect job opportunities and career plans are common. Candidates should focus on maintaining a positive mindset and leveraging their CPA designation to enhance their career prospects.

By addressing these common concerns with accurate information and a proactive approach, candidates can navigate the CPA score release process with confidence and clarity. It's important to remember that the journey to CPA certification is a valuable learning experience, and perseverance is key to achieving success.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about the CPA score release on October 31st:

- When will the CPA scores be released on October 31st? Scores are typically released in the early hours of the morning, but the exact timing may vary. Candidates should check the official NASBA website for updates on the release schedule.

- How can I access my CPA exam scores? Candidates can access their scores by logging into their NASBA accounts on the official website. Ensure that your login information is up to date and accessible ahead of time.

- What should I do if I don't pass the CPA exam? If you don't pass, take time to reflect on your performance, analyze your score report, and develop a targeted study plan for future attempts. Seek support and resources to enhance your preparation.

- How do CPA exam scores impact job opportunities? CPA exam scores and certification enhance your competitiveness in the job market, providing access to a wide range of job opportunities and career advancement prospects in accounting and finance.

- What is the passing score for the CPA exam? The passing score for each section of the CPA exam is 75. Candidates who achieve a score of 75 or higher are considered to have passed that section.

- How can I interpret my CPA exam results? Interpreting your results involves reviewing the scaled scores, performance feedback, and section-specific insights provided in your score report. This information can guide your study efforts and improvement plans.

Conclusion: Moving Forward After the CPA Score Release

The CPA score release on October 31st marks a significant milestone in the journey towards earning a CPA designation. Whether you pass all sections or need to retake certain parts, the outcome provides valuable insights and guidance for your professional development. By approaching the score release with a positive and proactive mindset, you can make informed decisions about your next steps and continue progressing towards your career goals.

Remember that the CPA certification journey is a testament to your dedication, perseverance, and commitment to excellence. Regardless of the challenges you may encounter, maintaining a focus on your long-term objectives and leveraging the support of peers and mentors can help you achieve success. As you move forward, embrace the opportunities and growth that the CPA designation offers, and continue striving for excellence in your accounting and finance career.

Article Recommendations