Mastering SC Estimated Tax Payments 2024: A Guide To Financial Preparedness

As South Carolina residents embark on the journey of filing taxes for the year 2024, understanding the nuances of SC estimated tax payments becomes paramount. Tax season can be daunting, but with the right guidance, taxpayers can navigate the complexities with ease. The SC estimated tax payments for 2024 represent a crucial aspect of financial planning, ensuring that individuals and businesses fulfill their tax obligations promptly and accurately.

The concept of estimated tax payments isn't new, yet it remains a topic shrouded in confusion for many. These payments are essentially prepayments on expected tax liabilities, crucial for those whose income isn't subject to withholding taxes, such as the self-employed, entrepreneurs, and investors. As we delve into the specifics of SC estimated tax payments 2024, it's essential to grasp the importance of adhering to deadlines and calculating the correct amounts to avoid penalties.

Being proactive in understanding SC estimated tax payments 2024 can save taxpayers from potential financial pitfalls. This article aims to demystify the process, offering insights into who needs to pay, how to calculate payments, and the implications of underpayment. With this knowledge, South Carolina taxpayers can approach the 2024 tax season with confidence, ensuring compliance and financial stability.

Read also:Taurus Man And Cheating Insights Into Loyalty And Relationships

Table of Contents

- Understanding Estimated Tax Payments

- Who Needs to Make Estimated Tax Payments?

- How to Calculate SC Estimated Tax Payments 2024?

- Important Deadlines for SC Estimated Tax Payments 2024

- Methods of Payment for SC Estimated Taxes

- Consequences of Underpayment

- Tips for Accurate Estimated Tax Payments

- How Does South Carolina Calculate Interest and Penalties?

- Adjustments and Changes for SC Estimated Tax Payments 2024

- Seeking Professional Help for Tax Planning

- Can Businesses Benefit from Paying Estimated Taxes?

- How to File SC Estimated Taxes Online?

- Common Mistakes to Avoid with SC Estimated Taxes

- FAQs

- Conclusion

Understanding Estimated Tax Payments

Estimated tax payments are periodic prepayments made by individuals and businesses to cover their expected tax obligations for the year. Unlike regular employment where taxes are withheld from paychecks, estimated taxes are necessary for those with sizable income streams from self-employment, investments, or other sources not subject to withholding.

These payments are made quarterly and are essential to avoid underpayment penalties. The goal is to ensure that by the end of the tax year, the individual or business has paid at least 90% of their total tax liability, or 100% of the previous year's tax liability, whichever is less.

Who Needs to Make Estimated Tax Payments?

Not everyone is required to make estimated tax payments. Generally, individuals who expect to owe at least $1,000 in taxes after subtracting their withholding and credits must make these payments. This includes self-employed individuals, freelancers, and those with significant income from dividends, rent, or alimony.

Businesses, including corporations and partnerships, also need to consider estimated tax payments if they expect to owe more than $500 in taxes. It's important to note that specific circumstances, like changes in income or deductions, can also necessitate these payments.

How to Calculate SC Estimated Tax Payments 2024?

Calculating SC estimated tax payments for 2024 involves determining your total expected income, deductions, and credits for the year. Here's a step-by-step guide:

- Estimate your total income for the year, considering all sources such as wages, self-employment income, and investments.

- Calculate any deductions and credits you expect to claim.

- Subtract the deductions and credits from your total income to determine your taxable income.

- Apply the appropriate tax rates to your taxable income to estimate your total tax liability.

- Subtract any expected withholding and credits from your estimated tax liability to determine the amount you need to pay through estimated payments.

- Divide the remaining amount by four to determine your quarterly payment amount.

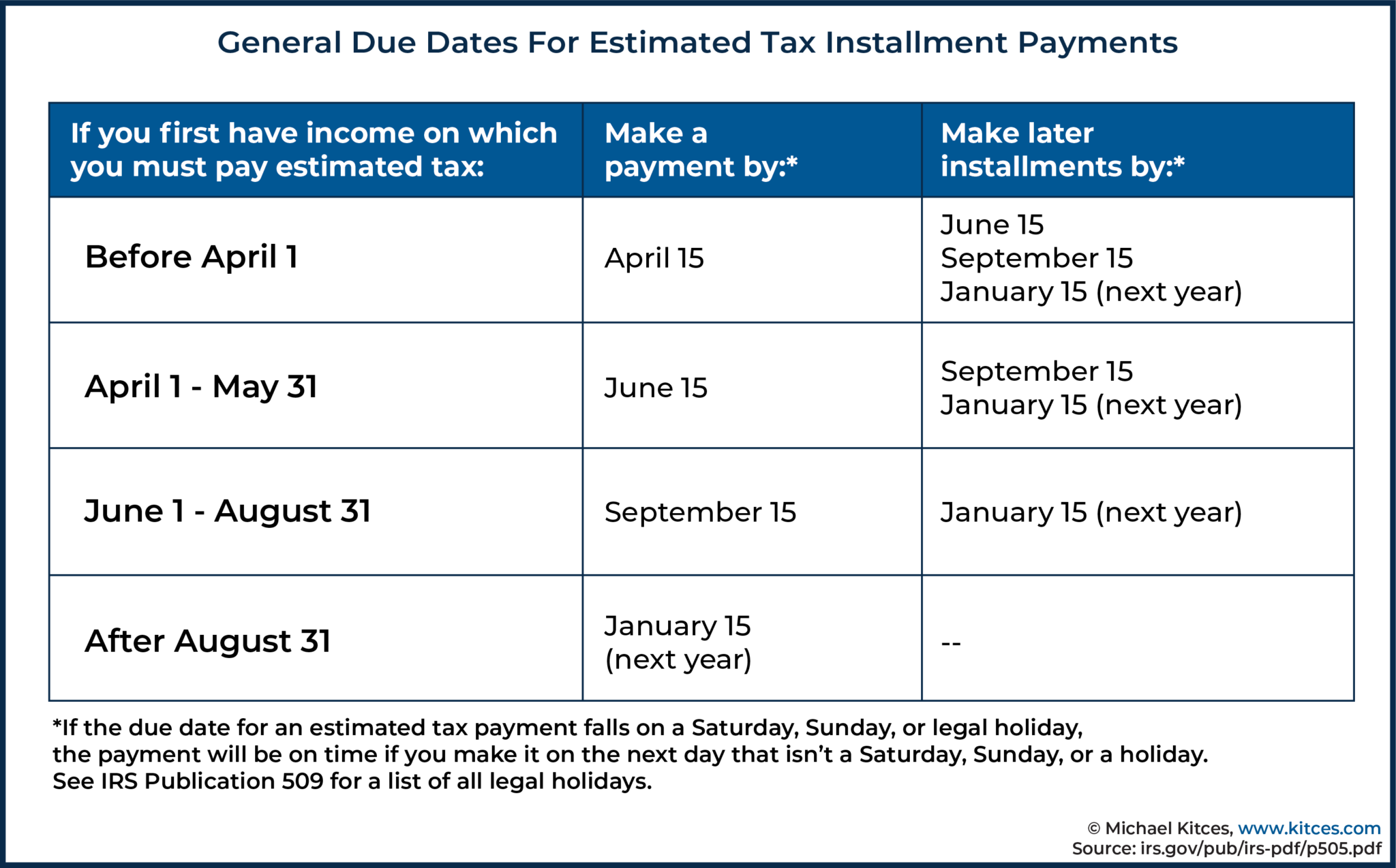

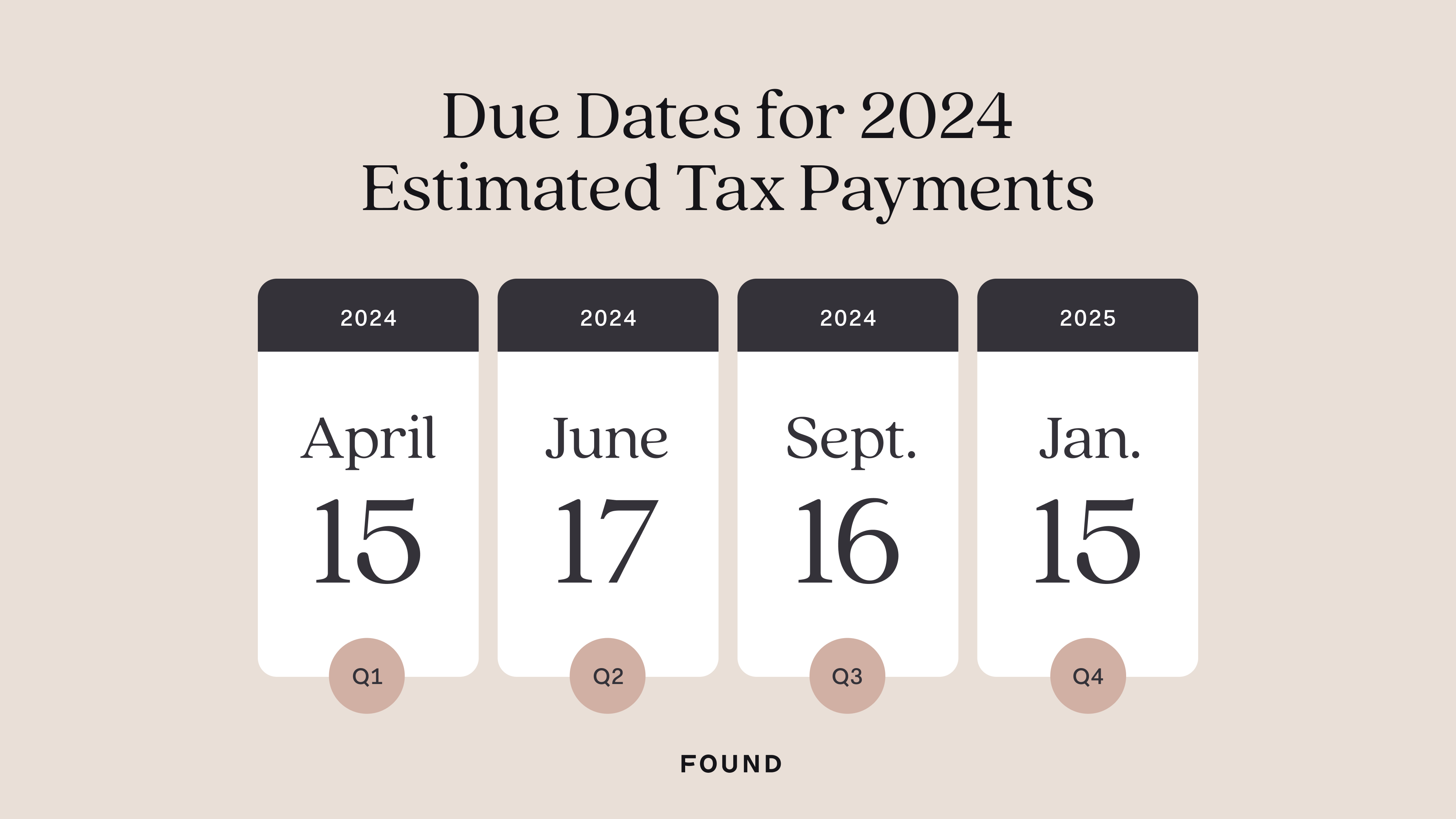

Important Deadlines for SC Estimated Tax Payments 2024

Meeting deadlines for estimated tax payments is crucial to avoid penalties. For the 2024 tax year, the estimated payment deadlines are as follows:

Read also:Jackky Bhagnani The Rising Star Of Indian Cinema

- First Quarter: April 15, 2024

- Second Quarter: June 15, 2024

- Third Quarter: September 15, 2024

- Fourth Quarter: January 15, 2025

If these dates fall on a weekend or holiday, the deadline is extended to the next business day. It's important to mark these dates on your calendar to ensure timely payments.

Methods of Payment for SC Estimated Taxes

South Carolina offers several methods for making estimated tax payments, including:

- Online Payments: The South Carolina Department of Revenue offers an online payment system where taxpayers can quickly and securely pay their estimated taxes.

- Mail: Taxpayers can also send a check or money order along with a payment voucher to the designated address for the South Carolina Department of Revenue.

- Electronic Funds Withdrawal (EFW): This method allows taxpayers to authorize a direct debit from their bank account, usually set up when filing electronically.

- Credit/Debit Card Payments: Payments can be made using a credit or debit card, though this may incur additional fees.

Consequences of Underpayment

Failing to make sufficient estimated tax payments can result in underpayment penalties. The IRS and South Carolina Department of Revenue impose penalties for underpayment to encourage timely payment and compliance.

The penalty is typically calculated based on the amount owed and the period it was underpaid. However, there are exceptions and waivers available for unusual circumstances, such as natural disasters or other hardships that affected your ability to pay on time.

Tips for Accurate Estimated Tax Payments

To ensure you're making accurate estimated tax payments, consider the following tips:

- Keep meticulous records of all income and expenses to accurately estimate your tax liability.

- Use tax software or consult a tax professional to help calculate your estimated payments.

- Review your tax payments each quarter and adjust as necessary if your income or deductions change.

- Consider setting aside a portion of your income in a separate account to ensure funds are available for tax payments.

How Does South Carolina Calculate Interest and Penalties?

South Carolina calculates interest and penalties on underpaid taxes based on the federal short-term rate, plus 3%. Penalties are assessed for each month or part of a month the tax is unpaid and can accumulate quickly.

The state provides relief from penalties in certain situations, such as if you can prove a reasonable cause for the underpayment or if you meet the safe harbor rule by paying at least 100% of the previous year's tax liability.

Adjustments and Changes for SC Estimated Tax Payments 2024

Tax laws and regulations can change, affecting how you calculate and pay estimated taxes. For 2024, be aware of any adjustments to tax brackets, deductions, or credits that could impact your tax liability.

Stay informed by regularly checking updates from the South Carolina Department of Revenue and the IRS. If significant changes occur, consider consulting a tax professional to ensure compliance and optimize your tax strategy.

Seeking Professional Help for Tax Planning

While many taxpayers handle estimated tax payments on their own, seeking professional help can provide peace of mind and ensure accuracy. Tax professionals can offer personalized advice, identify potential deductions, and help you navigate complex tax laws.

Consider working with a certified public accountant (CPA) or a tax advisor who specializes in your specific financial situation. Their expertise can help you make informed decisions and potentially save money.

Can Businesses Benefit from Paying Estimated Taxes?

Yes, businesses can greatly benefit from paying estimated taxes. Timely payments help maintain cash flow, reduce the risk of underpayment penalties, and facilitate better financial planning.

By staying on top of estimated tax payments, businesses can ensure compliance with tax laws, avoid surprises at the end of the year, and potentially improve their financial standing with creditors and investors.

How to File SC Estimated Taxes Online?

Filing SC estimated taxes online is a convenient and secure method that saves time and ensures accuracy. Follow these steps to file online:

- Visit the South Carolina Department of Revenue's website and navigate to the online payment portal.

- Log in or create an account if you're a new user.

- Select the option for estimated tax payments and follow the prompts to enter your payment information.

- Double-check your details before submitting the payment to avoid errors.

- Save or print the confirmation for your records.

Common Mistakes to Avoid with SC Estimated Taxes

Avoiding common mistakes can help ensure smooth and accurate estimated tax payments. Watch out for these pitfalls:

- Missing deadlines, resulting in penalties and interest charges.

- Underestimating income, leading to insufficient payments and potential penalties.

- Failing to adjust payments if your income changes throughout the year.

- Overlooking deductions or credits that could lower your tax liability.

FAQs

1. What happens if I miss a payment deadline?

Missing a payment deadline may result in penalties and interest charges. It's crucial to pay as soon as possible to minimize these fees.

2. Can I make changes to my estimated tax payments mid-year?

Yes, you can adjust your estimated tax payments if your income or deductions change. This helps ensure you're paying the correct amount each quarter.

3. What if my income is unpredictable?

If your income fluctuates, consider estimating conservatively and adjusting payments each quarter. Consulting a tax professional can also help navigate unpredictable income.

4. Are there penalties for overpaying estimated taxes?

No, there are no penalties for overpayment. Any excess payment can be applied to your next tax return or refunded.

5. How can I avoid penalties for underpayment?

To avoid penalties, ensure you pay at least 90% of your current year's tax liability or 100% of the previous year's liability, whichever is lower.

6. Can I pay estimated taxes with a credit card?

Yes, you can pay estimated taxes with a credit card, though additional fees may apply. Ensure you consider these costs before choosing this payment method.

Conclusion

Understanding and managing SC estimated tax payments for 2024 is essential for maintaining financial health and avoiding unnecessary penalties. By familiarizing yourself with the process, meeting deadlines, and making accurate payments, you can ensure compliance and potentially reduce your overall tax burden. Whether you're an individual taxpayer or a business owner, taking proactive steps toward mastering estimated taxes can lead to a smoother and more financially stable tax year.

Article Recommendations